Daily Technical Analysis & Forecast – 22 October 2025

Analysis Article

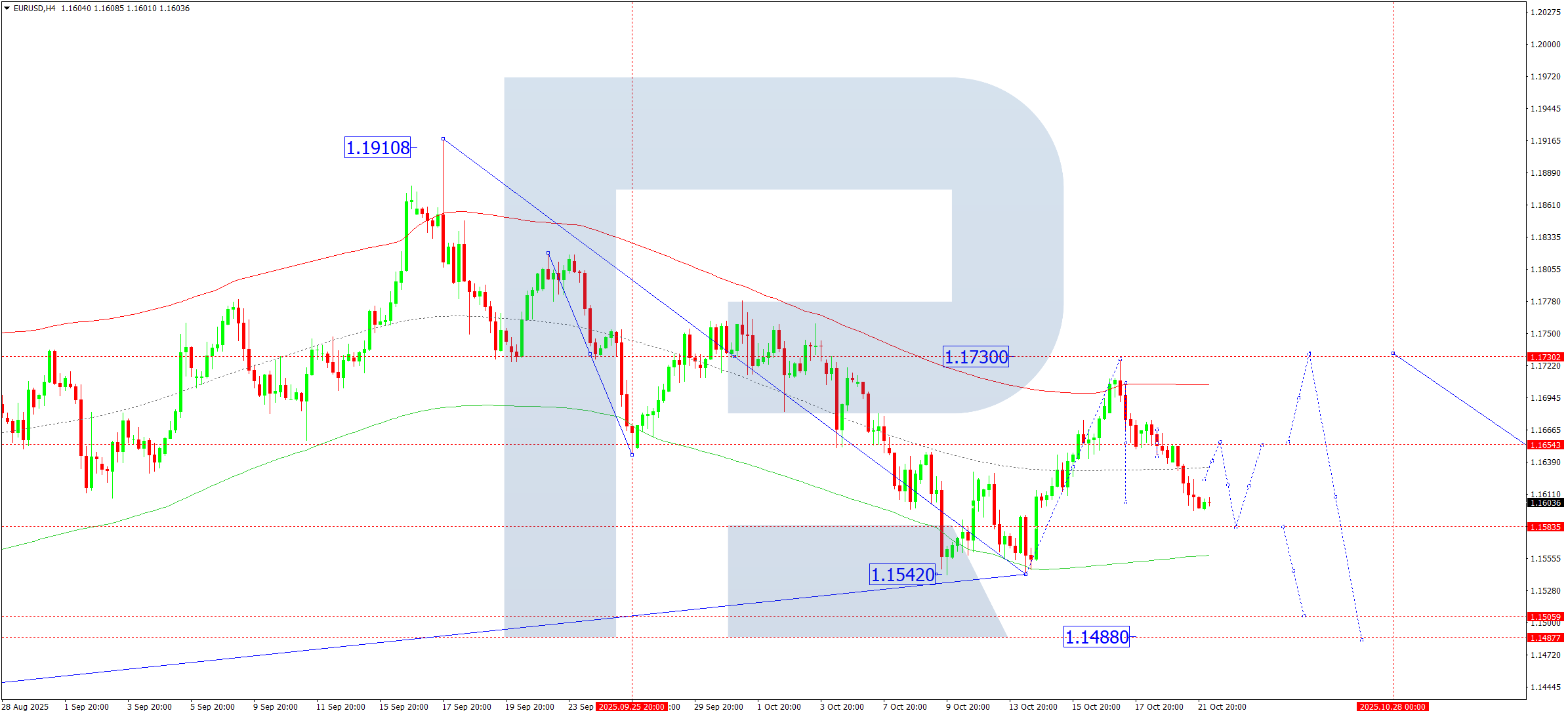

EURUSD Forecast

On the H4 chart, EURUSD completed a downward move to 1.1597. On 22 October 2025, a corrective rise to 1.1652 is anticipated, followed by a potential drop towards 1.1577, forming the boundaries of a broader consolidation phase.

A breakout above 1.1652 could push the pair up to 1.1730, while a break below 1.1577 may open the path to 1.1488, with a longer-term target near 1.1240.

- Key Pivot: 1.1730

- Wave Outlook: Bearish Elliott Wave pattern

- Technical View: Expecting a drop to 1.1577, then a short-term rebound to 1.1652

Today’s bias: Bearish towards 1.1577

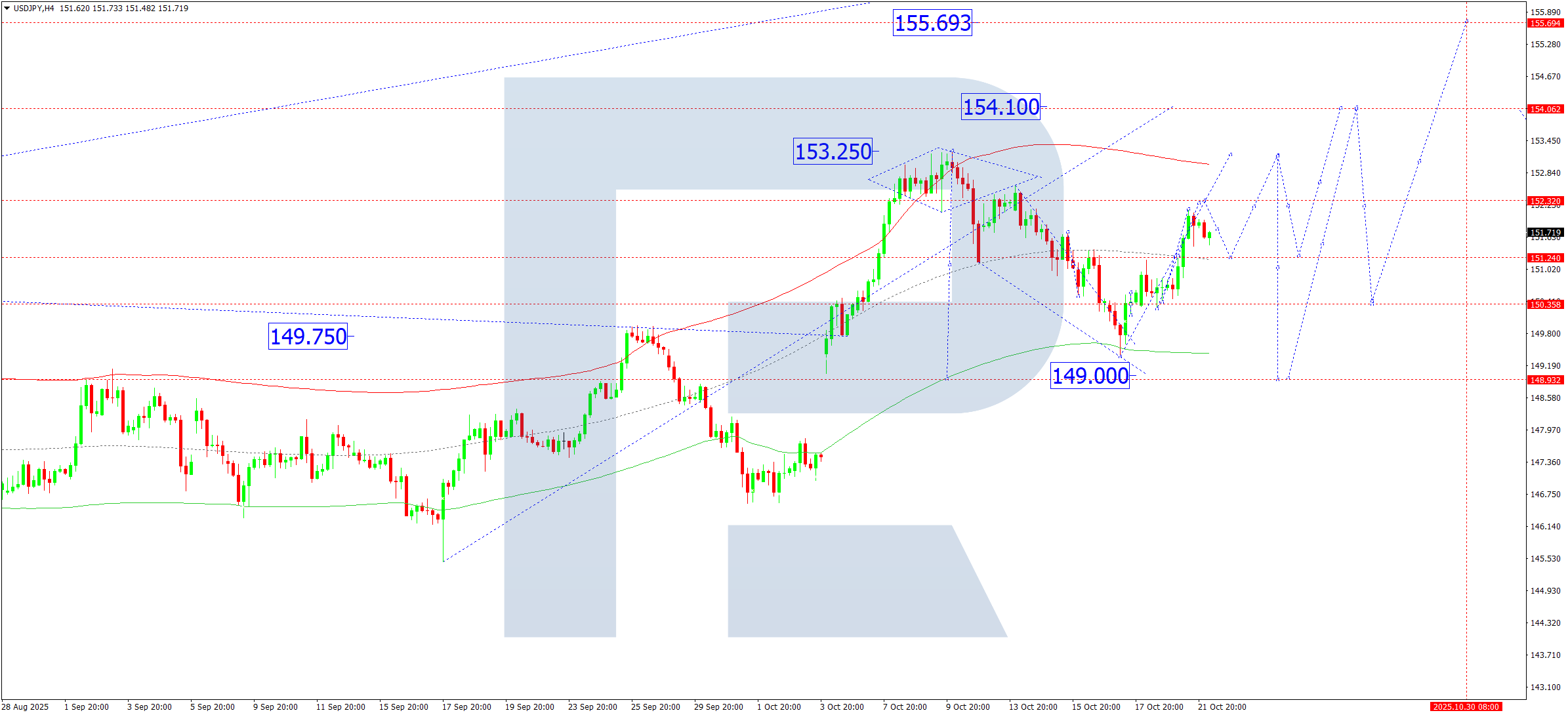

USDJPY Forecast

USDJPY reached 151.33 and is consolidating around this level on the H4 chart. A short-term rally towards 152.32 is expected, followed by a possible pullback to 151.37, before potentially continuing higher to 153.20.

- Key Pivot: 149.75

- Wave Outlook: Bullish Elliott Wave pattern

- Technical View: Price is positioned near the central line of the Price Envelope at 151.37

Today’s bias: Bullish towards 153.20

GBPUSD Forecast

GBPUSD broke below its consolidation zone near 1.3400, suggesting further downside to 1.3336. A corrective bounce to 1.3388 could follow, then another leg down toward 1.3300.

- Key Pivot: 1.3490

- Wave Outlook: Bearish

- Technical View: A potential drop to the lower boundary of the Price Envelope, followed by a correction, is expected

Today’s bias: Bearish towards 1.3300

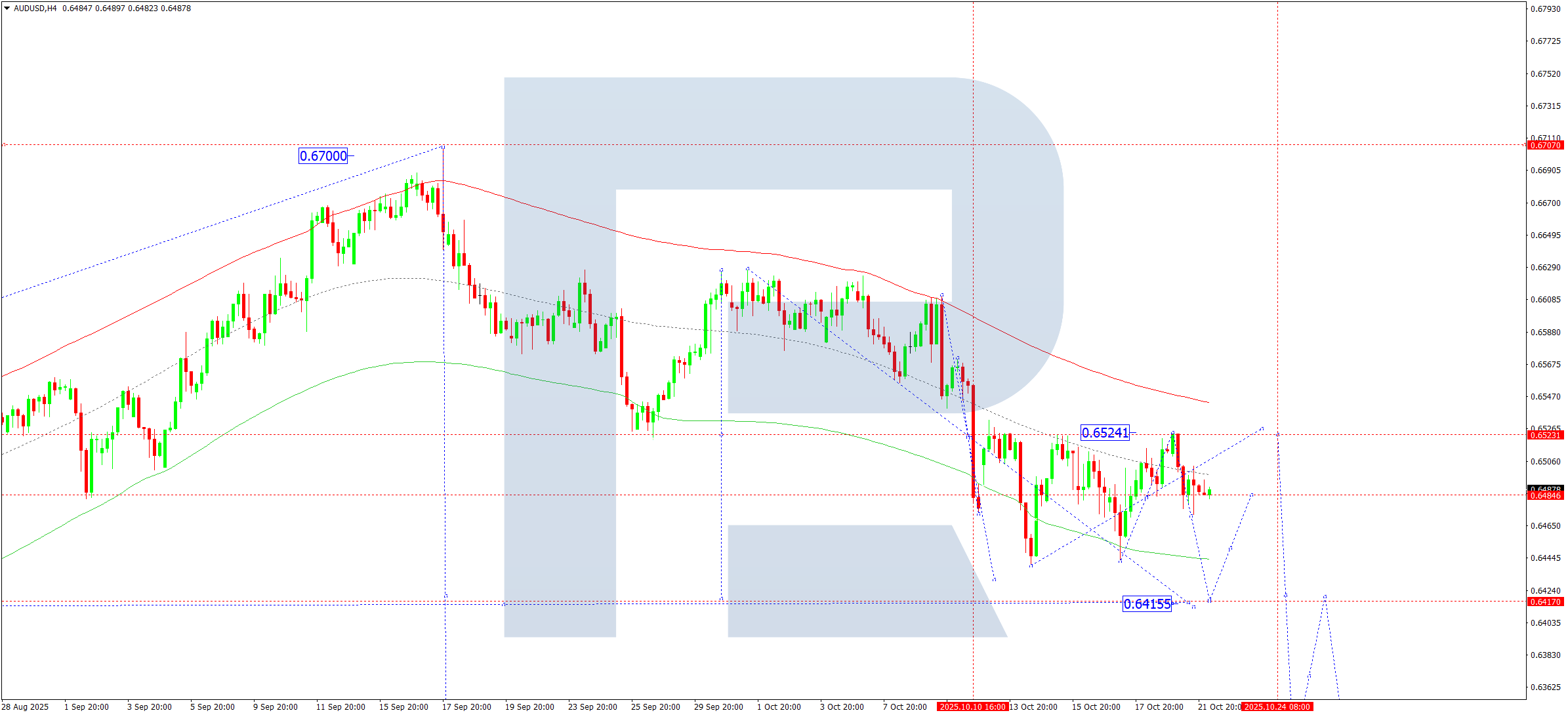

AUDUSD Forecast

AUDUSD is trading within a tight range near 0.6484. A breakout may lead to an upward move toward 0.6525, while a breakdown could drive the pair to 0.6415.

- Key Pivot: 0.6525

- Wave Outlook: Bearish

- Technical View: Price may first rise to the upper boundary near 0.6530, then fall back toward 0.6415

Today’s bias: Range-bound, watch for breakouts

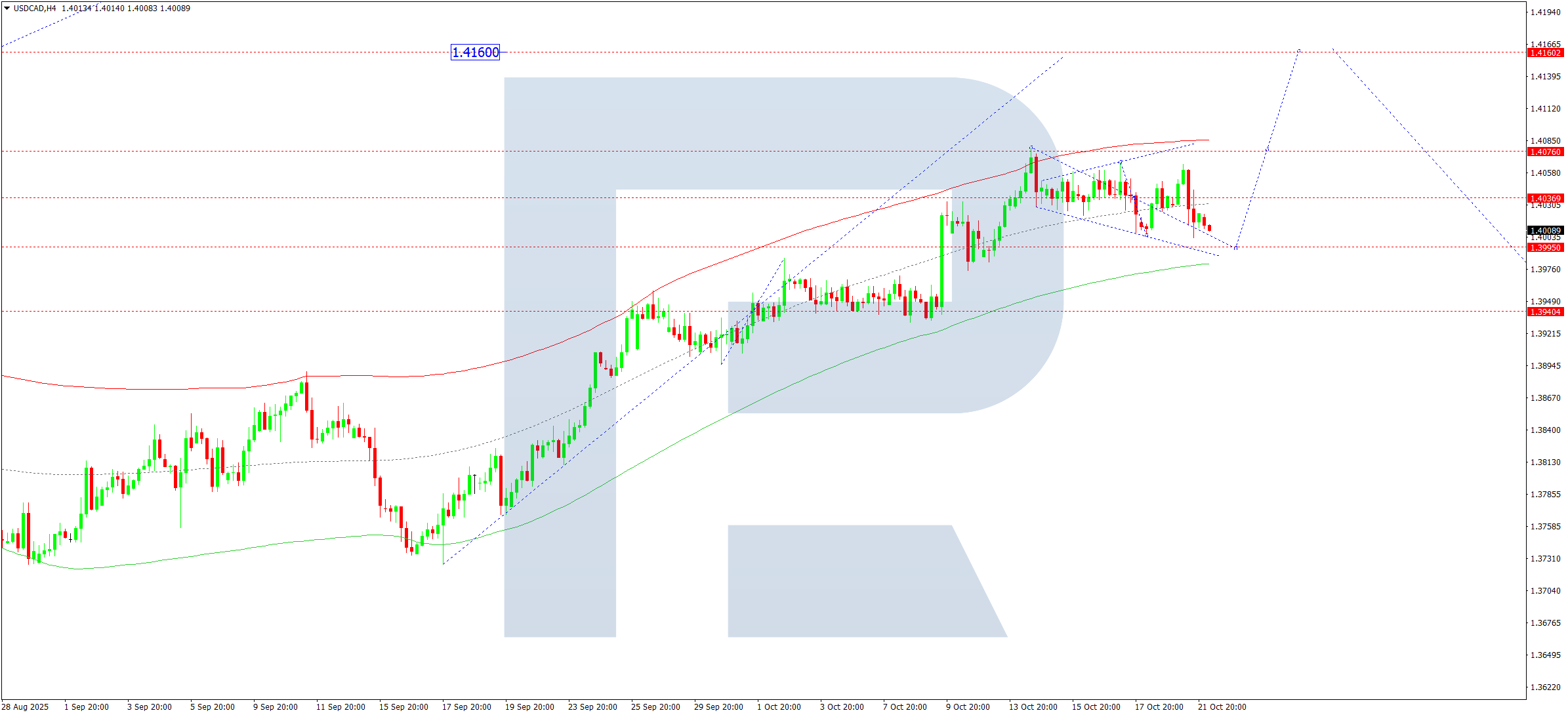

USDCAD Forecast

USDCAD remains in a consolidation zone around 1.4035. A potential dip to 1.3995 may occur before a rebound toward 1.4076, with a breakout possibly extending the rally to 1.4160.

- Key Pivot: 1.3940

- Wave Outlook: Bullish

- Technical View: A breakout above 1.4076 could confirm continued bullish momentum

Today’s bias: Bullish towards 1.4076 and 1.4160

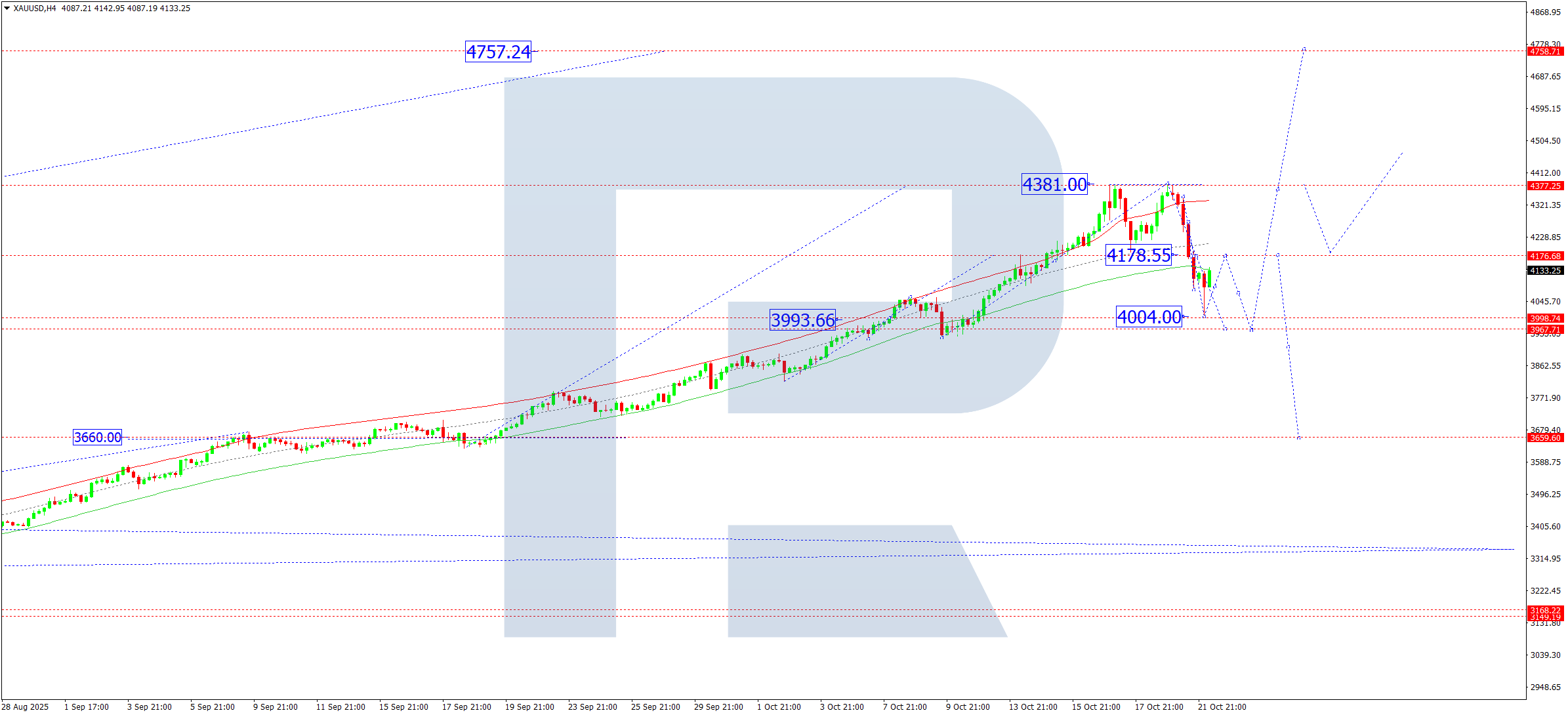

XAUUSD (Gold) Forecast

Gold broke below 4178, hitting a local downside target. A short-term rise back to 4178 is likely before a further decline towards 3967.

- Key Pivot: 3660

- Wave Outlook: Bullish longer-term, though near-term correction expected

- Technical View: The price is heading toward the lower boundary of the Price Envelope

Today’s bias: Bearish correction towards 3967

Brent Crude Oil Forecast

Brent is moving upward toward 62.15. After reaching this level, a pullback to 61.00 is possible, followed by further growth to 63.63, with a potential continuation to 65.00.

- Key Pivot: 65.65

- Wave Outlook: Mixed; corrective but with bullish continuation prospects

- Technical View: Price is rebounding from the lower boundary at 60.00 towards upper limits of the envelope

Today’s bias: Bullish towards 63.00–65.00

Risk Disclaimer: Past trading results do not guarantee future performance. Always conduct your own analysis before making investment decisions.

You may also like

Powered by Investing.com

Leave a Reply