Monthly Technical Analysis & Forecast – September 2025Date: 02.09.2025

Analysis Article

Table of Contents

- Key Technical Levels to Watch – September 2025

- EURUSD Forecast

- USDJPY Forecast

- GBPUSD Forecast

- AUDUSD Forecast

- USDCAD Forecast

- XAUUSD (Gold) Forecast

- Brent Crude Oil Forecast

Key Technical Levels – September 2025

| Instrument | Support Levels | Resistance Levels |

|---|---|---|

| EURUSD | 1.1300, 1.1200 | 1.1850, 1.2000 |

| USDJPY | 146.00, 145.00 | 151.00, 153.00 |

| GBPUSD | 1.3030, 1.2620 | 1.3600, 1.3800 |

| AUDUSD | 0.6222, 0.6020 | 0.6625, 0.6700 |

| USDCAD | 1.3770, 1.3550 | 1.3850, 1.3940 |

| Gold (XAUUSD) | 3,390, 3,320 | 3,470, 3,530 |

| Brent Crude Oil | 60.00, 58.50 | 68.70, 78.50 |

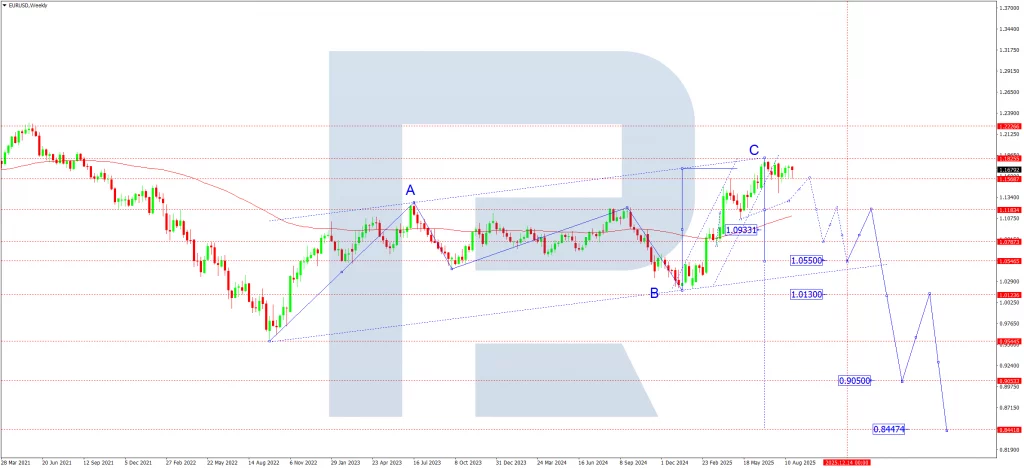

EURUSD Forecast

Fundamentals:

In September, attention shifts to the ECB meeting and upcoming U.S. inflation and labor data. Market sentiment still favors the U.S. dollar due to economic divergence and expectations for prolonged Fed policy tightening. Geopolitical risks may further support safe-haven demand for USD.

Technical Outlook:

EURUSD has completed a five-wave upward correction (wave C) from 1.0180 to 1.1825 and is now consolidating near 1.1570. A downward move toward 1.1300 is likely, followed by a retest of 1.1570 from below. Deeper targets include 1.0787, and potentially 1.0550, with the broader bearish wave aiming for 0.8444.

Scenarios:

- Bearish (Base): Break below 1.1555 → 1.1300 → 1.0550 → 0.8444

- Bullish (Alternative): Break above 1.1850 → 1.2000 → 1.2222

USDJPY Forecast

Fundamentals:

The Fed’s firm stance contrasts with the BoJ’s ultra-loose policy. While this supports USD strength, interventions by Japanese authorities and shifts in global risk sentiment may support the yen.

Technical Outlook:

USDJPY has completed an A-B-C correction, topping near 150.78. A break below 145.00 may trigger a decline toward 139.87, with further potential to 128.88 by year-end.

Scenarios:

- Bullish (Base): Break above 150.80 → 153.00

- Bearish (Alternative): Break below 146.00 → 139.87 → 128.90

GBPUSD Forecast

Fundamentals:

While the BoE leans dovish, resilient UK labor data limits downside. The Fed’s ongoing hawkish tone supports USD strength, adding pressure to GBPUSD.

Technical Outlook:

After peaking at 1.3777, GBPUSD retraced to 1.3140 and is consolidating below 1.3590. A downside breakout may lead to 1.3030 or 1.2620; an upside move could target 1.3920.

Scenarios:

- Bearish (Base): Break below 1.3030 → 1.2620

- Bullish (Alternative): Break above 1.3600 → 1.3920

AUDUSD Forecast

Fundamentals:

AUD remains under pressure amid weak domestic data, dovish RBA stance, commodity volatility, and a firm USD. Chinese economic uncertainty adds to headwinds.

Technical Outlook:

AUDUSD completed a correction at 0.6624. A break below 0.6410 could open the path to 0.6222 or lower toward 0.5820.

Scenarios:

- Bearish (Base): Break below 0.6410 → 0.6222 → 0.6020 → 0.5820

- Bullish (Alternative): Break above 0.6625 → 0.6700 → 0.6910

USDCAD Forecast

Fundamentals:

Oil prices, U.S.-Canada rate differentials, and Canadian economic data will shape the outlook. Higher oil prices cap USD gains, while the Fed’s tight stance supports the dollar.

Technical Outlook:

USDCAD is forming a bearish Flag. A break below 1.3720 may trigger a decline to 1.3500 or even 1.3270. If prices rise above 1.3850, the bullish scenario becomes viable.

Scenarios:

- Bearish (Base): Below 1.3720 → 1.3500 → 1.3270

- Bullish (Alternative): Break above 1.3850 → 1.3940 → 1.4020

Gold (XAUUSD) Forecast

Fundamentals:

Mixed factors dominate gold: expectations of Fed easing support demand, but a stronger USD and risk-on sentiment cap gains. Geopolitical events continue to drive volatility.

Technical Outlook:

Gold broke out of a Pennant with an upside target at 3,530. A correction from that zone is likely, with support at 3,030 and deeper levels around 2,780–2,530.

Scenarios:

- Bearish (Base): Rejection at 3,530 → 3,330 → 3,030 → 2,530

- Bullish (Alternative): Hold above 3,390 → retest 3,530 → breakout could target new highs

Brent Crude Oil Forecast

Fundamentals:

Oil prices are influenced by global demand, OPEC+ policy, and geopolitical tensions. Slowing growth weighs on prices, but risks in the Middle East and OPEC+ actions can offer support.

Technical Outlook:

Brent is in an upward wave. Resistance lies at 78.50. A pullback to 68.70 is possible before further upside toward 88.00 and 97.50. A drop below 68.70 could test 60.00—key support and profitability level for many exporters.

Scenarios:

- Bullish (Base): Hold above 68.70 → 88.00 → 97.50 → 105.00

- Bearish (Alternative): Break below 68.70 → 60.00

Disclaimer:

Past performance is not indicative of future results. All forecasts and technical analyses are based on current market conditions and are subject to change. Trading involves significant risk. Always consult a financial advisor before making investment decisions.

You may also like

Powered by Investing.com

Leave a Reply