Daily Technical Analysis & Forecast – 1 August 2025

Analysis Article

EURUSD Forecast

On the H4 timeframe, EURUSD continues to consolidate around 1.1420. For today, the price range is expected to stretch from 1.1387 to 1.1421. A short-term correction toward 1.1487 is possible before resuming the downward movement toward the 1.1185 target.

The Elliott Wave structure and the price matrix support this scenario, with 1.1487 acting as a pivotal level. The pair is forming a bearish wave pattern, potentially reaching the lower boundary of the price envelope near 1.1185, followed by a possible rebound to 1.1487.

Outlook: Bearish movement toward 1.1185.

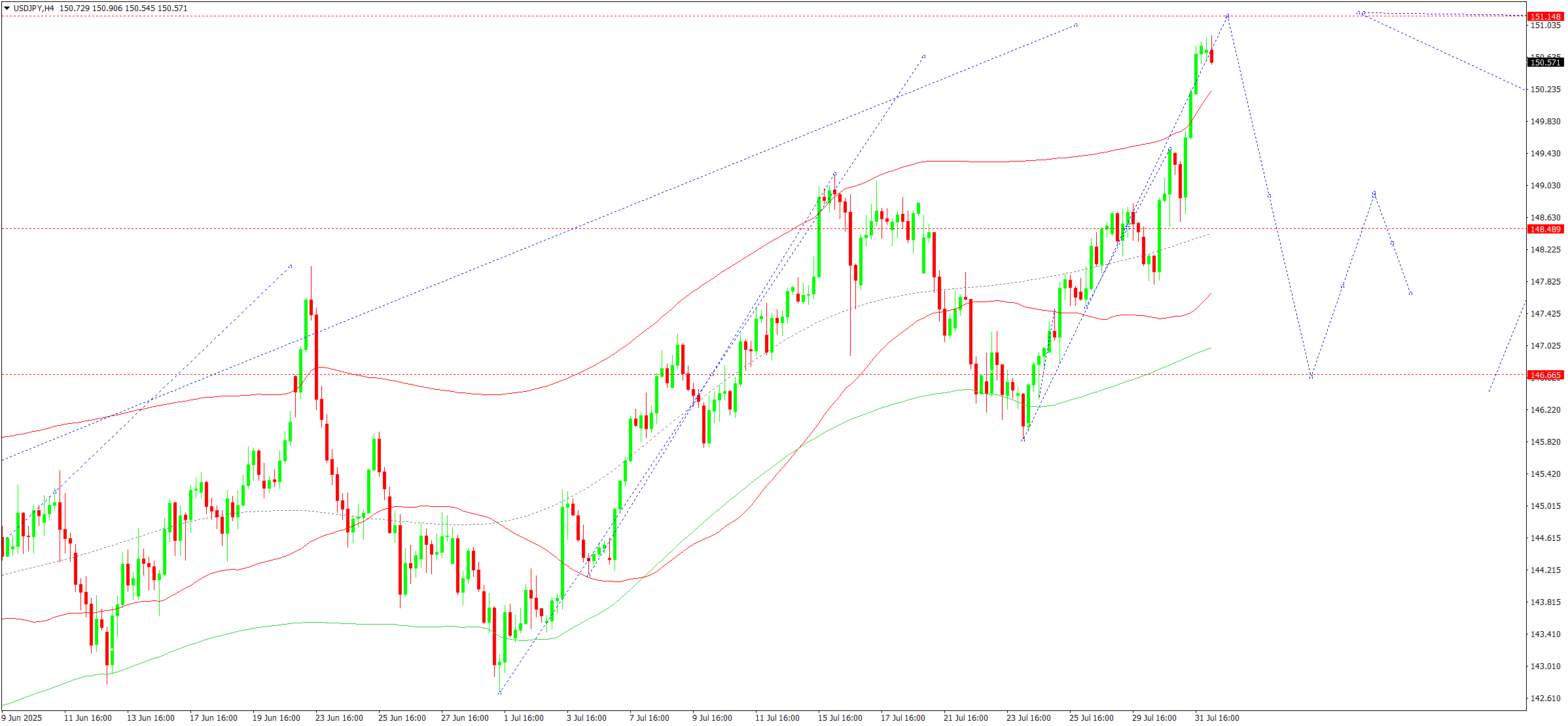

USDJPY Forecast

USDJPY has broken out upward from its consolidation range around 148.62 on the H4 chart. The pair is projected to rise towards 151.45 today. After that, a pullback to retest 148.62 is expected, followed by another upward leg toward 153.40.

The Elliott Wave model, anchored at 148.62, supports this bullish scenario. After touching the upper boundary of the price envelope near 151.45, the pair may dip before continuing its upward momentum toward 153.40.

Outlook: Bullish with targets at 151.45 and 153.40.

GBPUSD Forecast

GBPUSD remains in a downward trend on the H4 chart, moving toward a near-term target of 1.3155. A corrective bounce to 1.3370 could follow, before continuing the downtrend toward 1.2950.

The Elliott Wave pattern confirms 1.3370 as a key level. The pair is aiming for the lower envelope at 1.3155 before a correction to the centerline.

Outlook: Bearish toward 1.3155, with a potential correction to 1.3370.

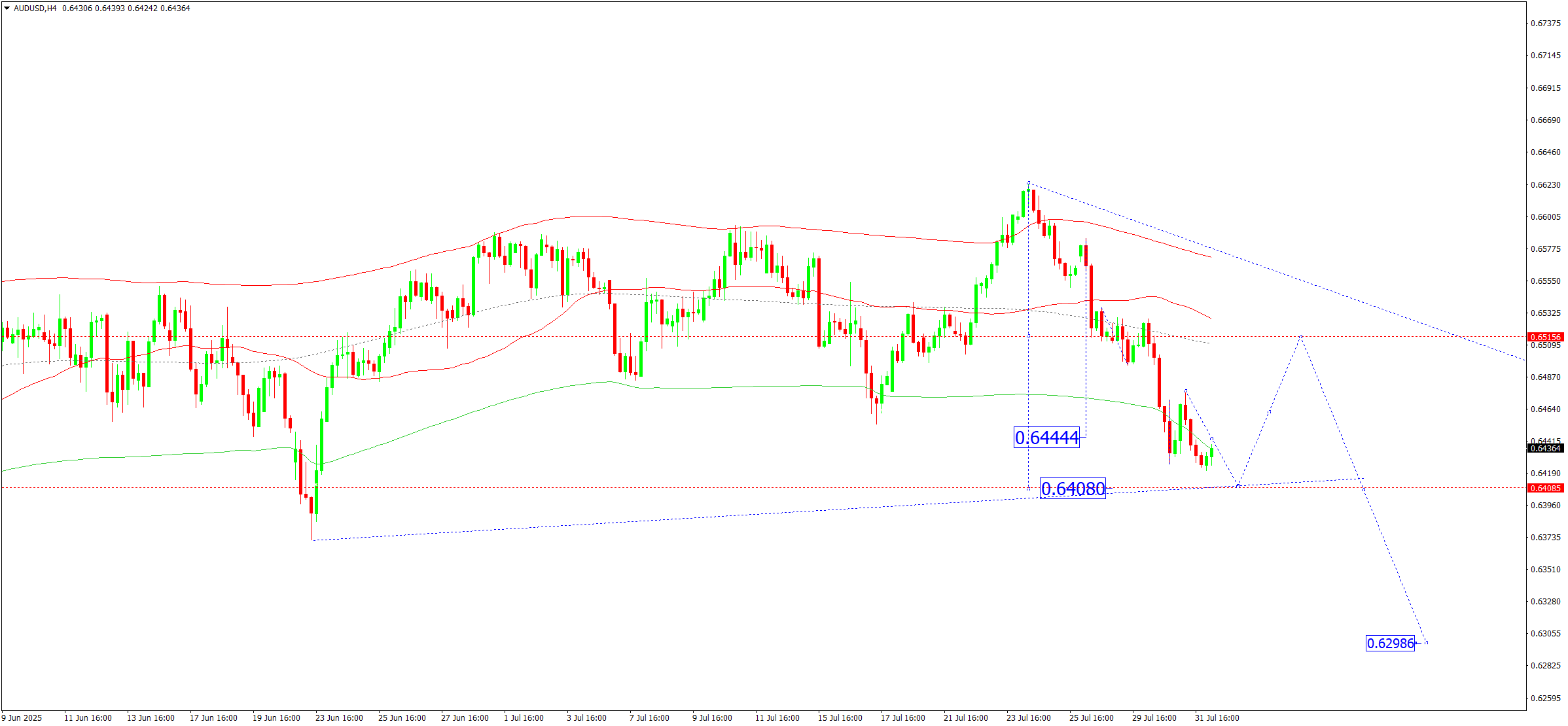

AUDUSD Forecast

AUDUSD is consolidating near 0.6444 on the H4 chart. An upward breakout may push it toward 0.6555, while a downward move could extend losses to 0.6408 initially.

According to the wave matrix, 0.6515 is a crucial pivot. The pair is forming a downside wave, potentially reaching the lower price envelope near 0.6408. A recovery to 0.6515 may follow, but the downtrend could continue thereafter.

Outlook: Bearish toward 0.6408.

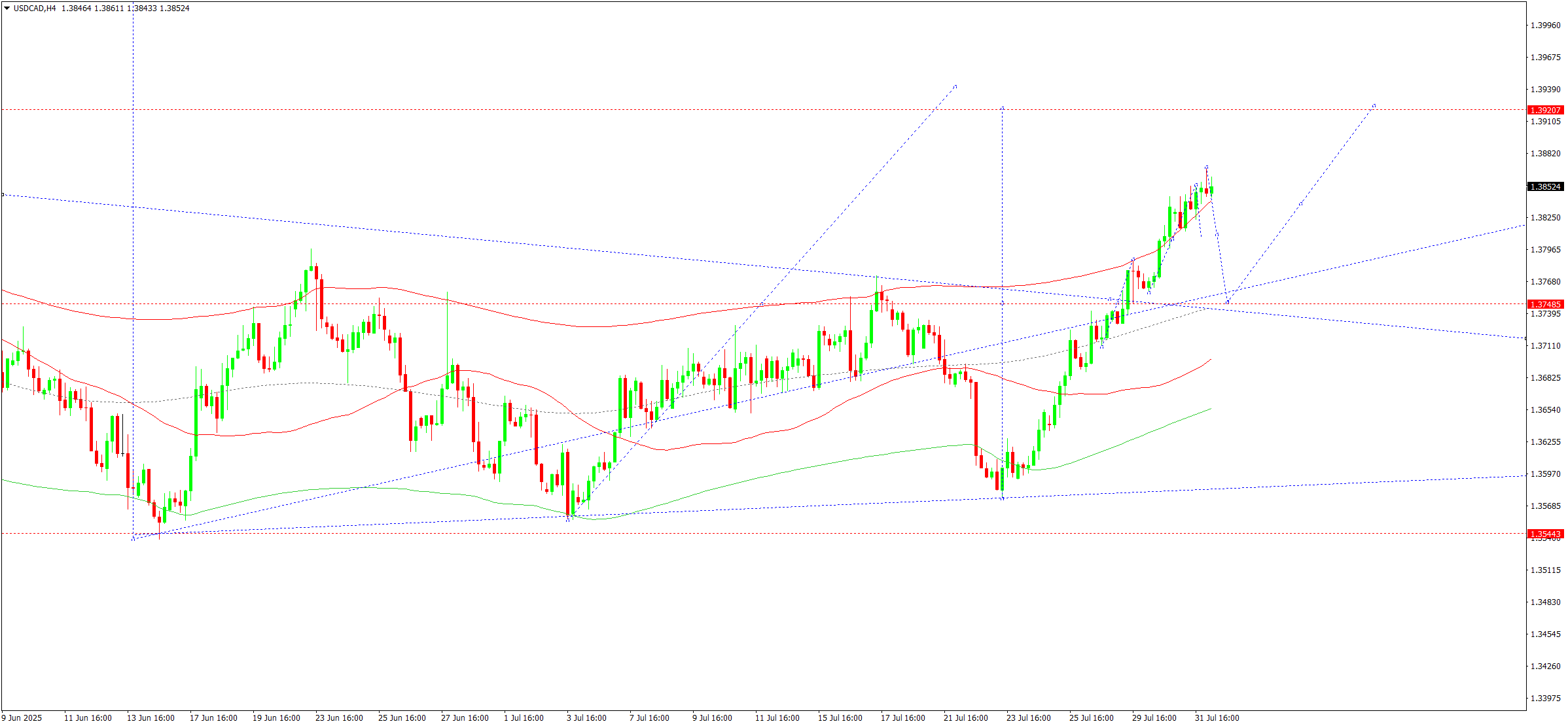

USDCAD Forecast

USDCAD has broken above its consolidation around 1.3747 on the H4 chart. Today, the pair is expected to continue climbing toward 1.3920. A subsequent pullback to retest 1.3750 is possible.

The Elliott Wave structure identifies 1.3750 as a key pivot. The breakout from the envelope’s midline signals further strength toward the upper boundary at 1.3920.

Outlook: Bullish toward 1.3920.

XAUUSD (Gold) Forecast

Gold is consolidating around 3,300 on the H4 chart, with the current range stretching from 3,268 to 3,314. A move lower to 3,247 is anticipated today.

The downward wave structure points to 3,345 as the pivot. The bearish trend is expected to reach the lower envelope near 3,247, potentially followed by a rebound to 3,345 and further decline toward 3,150.

Outlook: Bearish toward 3,247.

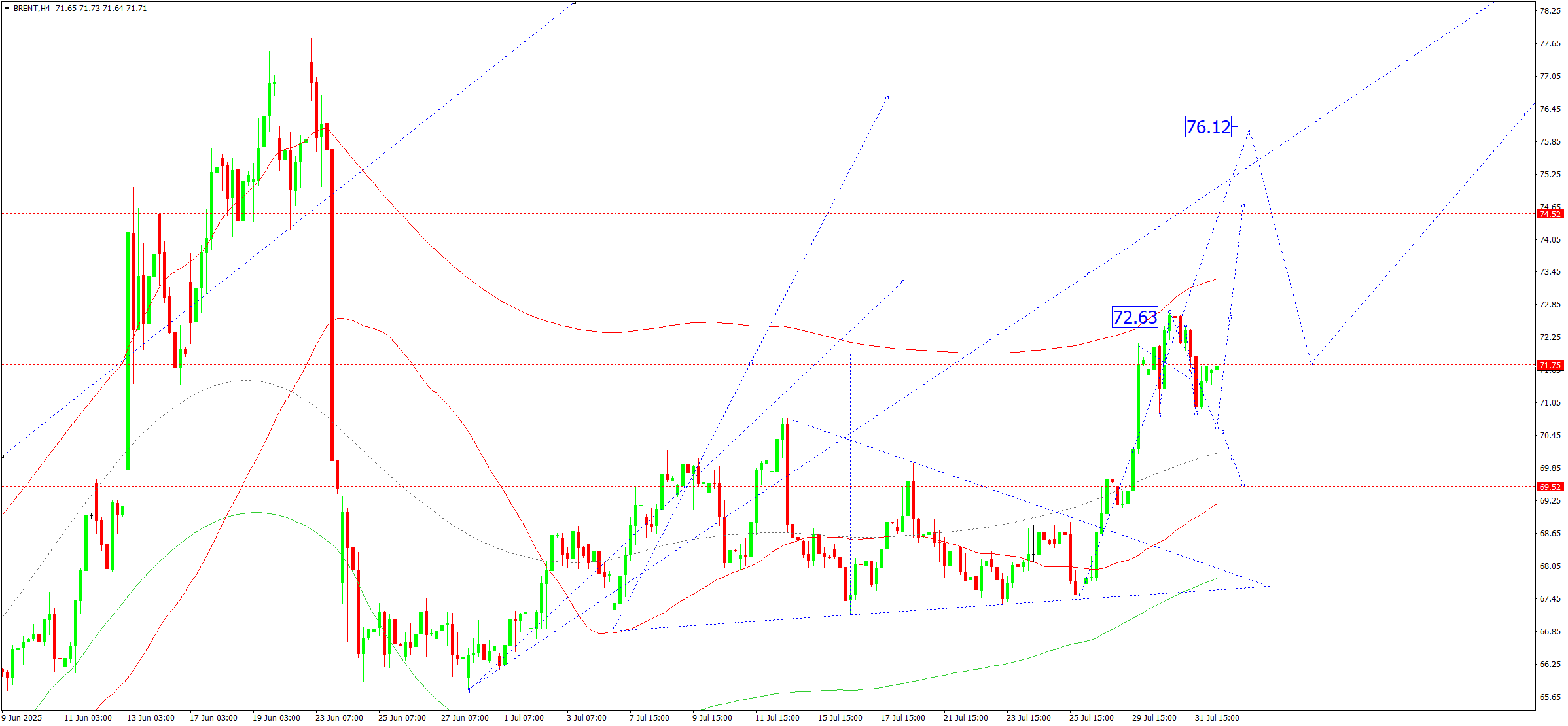

Brent Crude Forecast

Brent is consolidating around 71.75. A breakout lower could lead to a dip to 70.00, while an upward breakout opens the path toward 73.33, with a possible extension to 76.00.

The growth wave is structured around the pivot at 71.80. A decline to 70.00 may precede a bullish continuation to the upper envelope at 73.33, and potentially to 76.00. A pullback to 70.80 might occur after the advance.

Outlook: Bullish toward 73.33 and 76.00.

Disclaimer: Past performance is not indicative of future results. This analysis is for informational purposes only and does not constitute investment advice.

You may also like

Powered by Investing.com

Leave a Reply